MARKETING DIGITAL COM ESTRUTURA VENCEDORA PARA NEGÓCIOS LOCAIS

Aplicação

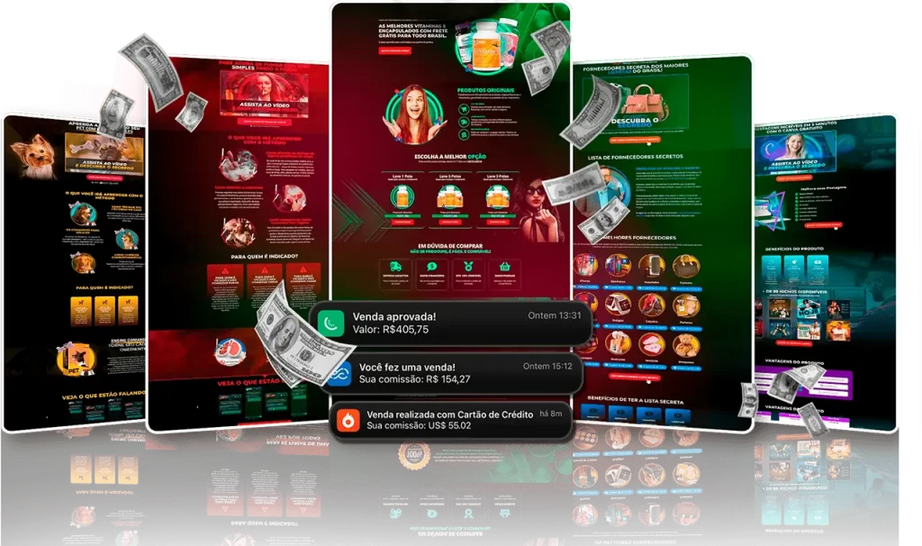

Escolha um dos modelos ideais para o seu tipo de negócio e nicho, são dezenas disponíveis para inspiração.

Instalação

Personalizamos o modelo de site para se adequar com a identidade visual da sua empresa transparecendo profissionalismo.

Marketing

Realizamos o marketing digital da sua página e empresa para transformar potenciais clientes em clientes, alcançando clientes localmente.

ALCANCE MAIS CLIENTES

COM NOSSO MÉTODO OCEANO LOCAL BUSINESS (OLB 100)

Sofrendo para conquistar e trazer novos clientes para sua empresa ou serviço? A Oceanoweb.net é uma agência de marketing focada em pequenos negócios. Oferecemos soluções para empresas atraírem potenciais clientes em sua região.

Nosso serviço inclui a analise por oportunidades, criação de um site (landing page) como estratégia para fazer com que clientes entrem em contato rapidamente com sua empresa, além da otimização de sua empresa no Google Maps, caso não tenha.

O principal objetivo é que pessoas que busquem produtos ou serviços que sua empresa ofereça, encontre o seu perfil no Google e de diversas formas e confie nela. Um perfil profissional com site com design limpo e deslumbrante ajudam bastante nessa tomada de decisão.

NOSSOS DIFERENCIAIS

Carregamento

Ultra Rápido

Seu site ou landing page hospedado em um dos melhores servidores do mundo. Garantindo carregamento ultra rápido em milésimos de segundos. E fazendo com que 100% dos clientes acessem sua página e não desistam da navegação.

Amigável com Mecanismos de Busca e Google

Realizamos a otimização de seu site com SEO OnPage, tornando o site mais propenso a aparecer de forma competitiva nas buscas do Google para seus produtos ou serviços de forma fácil e rápida, apesar de não ser garantido.

Design Deslumbrante e Profissional

Tenha um design "clean" e deslumbrante que ofereça uma sensação de profissionalismo de alto nível para seus potenciais clientes que virão da internet se conectarem de forma rápida e fácil e total confiança no seu serviço ou produto.

PORQUE VOCÊ PRECISA DE UMA LANDING PAGE?

Aumentar a visibilidade e a credibilidade da sua marca. Um site é uma vitrine virtual que mostra quem é a sua empresa, o que ela faz, quais são os seus valores e diferenciais. Um site também transmite confiança e profissionalismo aos seus potenciais clientes, que podem encontrar informações relevantes e atualizadas sobre os seus produtos ou serviços.

Ampliar o seu alcance e o seu mercado. Um site permite que a sua empresa seja encontrada por pessoas de qualquer lugar do mundo, a qualquer hora do dia ou da noite. Um site também facilita a comunicação com os seus clientes, que podem entrar em contato com você por meio de formulários, chats, e-mails ou redes sociais. Além disso, um site pode integrar ferramentas de marketing digital, como SEO, Google Ads, redes sociais e e-mail marketing, que ajudam a atrair mais visitantes e gerar mais vendas.

Melhorar o seu relacionamento com os seus clientes. Um site é uma ótima forma de manter os seus clientes informados sobre as novidades da sua empresa, como lançamentos, promoções, eventos, dicas e conteúdos de valor. Um site também permite que você colete feedbacks, sugestões e reclamações dos seus clientes, que podem ajudar a melhorar o seu produto ou serviço. Além disso, um site pode oferecer recursos de pós-venda, como suporte técnico, garantia, troca ou devolução.

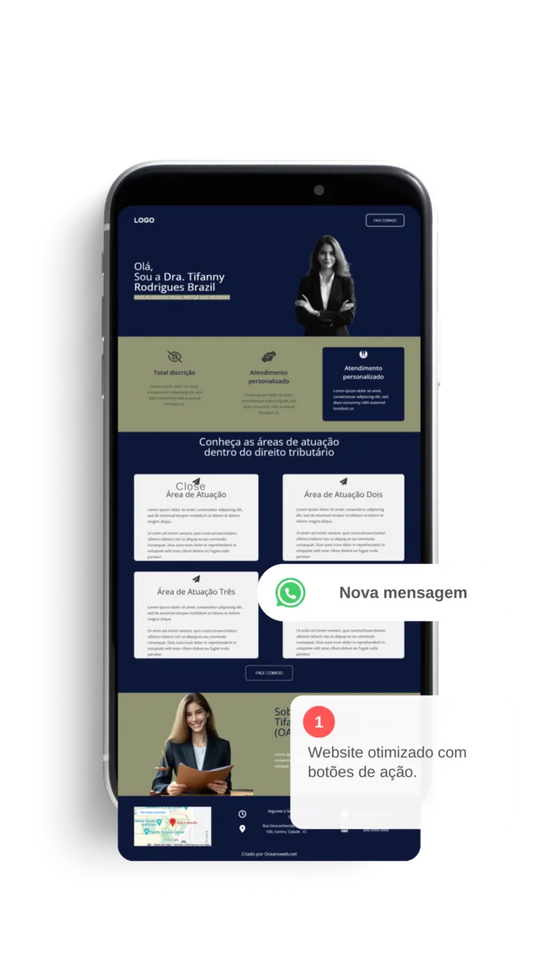

CONSTRUÇÃO LANDING PAGE ADVOCACIA

Com centenas de sites desenvolvidos a Oceanoweb também se destaca na criação de páginas para Advocacia.

Apresentação de especialidades de forma limpa e organizada.

Destaque para atendimento personalizado para atrair atenção do potencial cliente.

Botões de ação para contato via Whatsapp para mais informações.

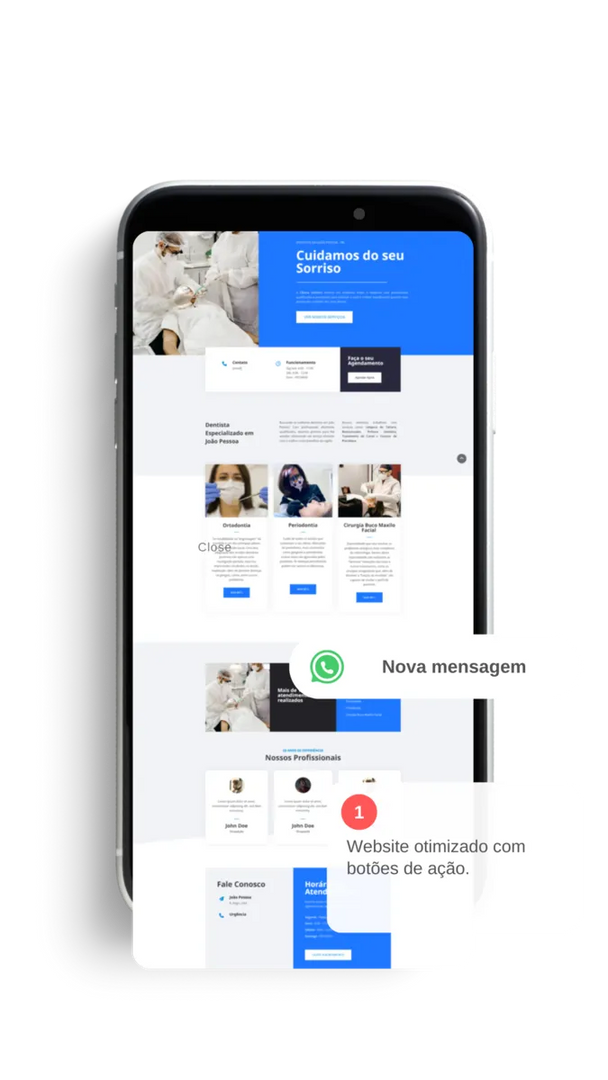

CONSTRUÇÃO LANDING PAGE SERVIÇOS

Tem uma empresa de serviço? Papa entulho? Arquitetura? Vidraçaria? Dentista? Instalação de Ar-Condicionado? Somos especializados.

Apresentação clara dos serviços para que tanto o potencial cliente encontre, ou o Google encontre o site com mais facilidade.

Com centenas de sites desenvolvidos a Oceanoweb também se destaca na criação de páginas para Advocacia.

Botões para ação estratégicos, afim de que o potencial cliente entre em contato rapidamente.

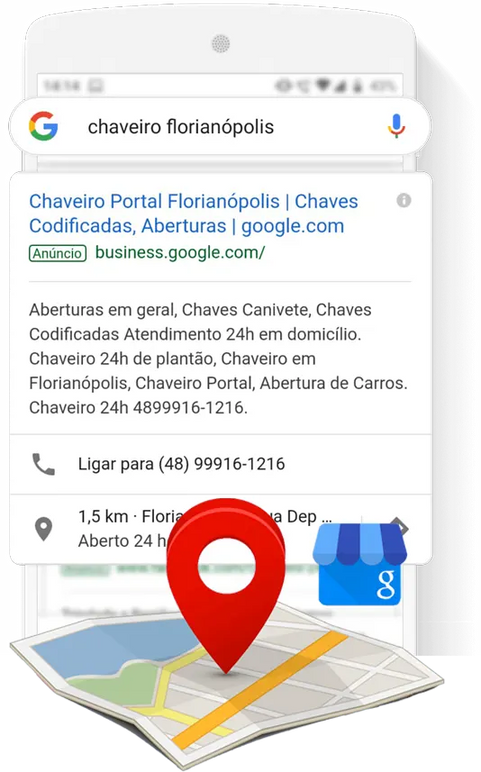

TRANSFORME CLIQUES EM CLIENTES

Google Ads é a ferramenta de anúncios através de links patrocinados no Google que disponibiliza um espaço importante das páginas de pesquisa para os anunciantes que desejam exibir seu negócio para um público específico.

Com Google Ads você pode anunciar seus produtos e/ou serviços em múltiplos e efetivos meios de comunicação quando os usuários estão buscando informação relacionada com seus produtos e/ou serviços.

PROMOVER MINHA EMPRESA

QUER PRESENÇA DIGITAL, MAS NÃO SABE COMO?

Sabemos o quanto pode ser desgastante o processo de conseguir novos clientes. É por isso que a Oceanoweb nasceu em 2013. Justamente para aproximar pequenas empresas destes potenciais clientes que buscam por produtos e serviços diariamente na internet. Tudo de forma simples, rápido e sem burocracia.

O resultado do nosso serviço é medido pela satisfação dos mais de 1.000 clientes atendidos durante nossa trajetória desde 2013.

10+ Sites publicados mensalmente com Método Oceano Local Business 100 (OLB 100)

Magrão Entulhos

Muito bom, realmente recomendo os serviços da empresa. Sem enrolação e com design ótimo!

Valentin Joias

O site ficou perfeito! Muito obrigado, é inspirador.

Potosi Decor Móveis

A Oceanoweb foi essencial em nossa estratégia de marketing oferecendo um página com carregamento super rápido

CASE DE SUCESSO

A POTOSI DECOR teve sucesso em promover sua nova filial em Porto Velho - RO, após contratar a Oceanoweb.net. Que ficou responsável por criar presença na internet através de uma Landing Page deslumbrante e otimização de seu perfil no Google com o intuito de impressionar os potenciais clientes e aparecer de forma competitiva para quem busca por móveis em Porto Velho - RO.

Média de 70 rotas por mês

Média de 50 ligações por mês

PRINCIPAIS DÚVIDAS

Meu site irá aparecer no Google?

Sim! Todos os nossos sites são amigáveis com o Google. No entanto, após a sua publicação pode demorar até uma semana para que ele seja indexado no mecanismo de busca. Vale ressaltar que não é garantido que o site fique na primeira página, apesar de uma grande probabilidade. Afinal, tudo depende da concorrência do ramo de cada empresa.

Posso alterar algo no site?

Para alterar algo no site é preciso entrar em contato com o suporte técnico. Podemos alterar conteúdo, logo, imagens e botões de chamada para ação para se adequar a sua estratégia.

Posso anunciar meu site no Google ou Facebook?

Sim! Pode. No entanto, não é possível instalar um Pixel diretamente no site. Ou seja, informações de conversão não serão disponibilizadas.

GARANTIA INCONDICIONAL

Se por qualquer motivo durante 30 dias você não goste do serviço ou produto te reembolsaremos o valor parcial do plano (sem valor gasto em anúncios) que você investiu na OceanoWeb, basta entrar em contato com nossa equipe. Prezamos pela satisfação máxima de nossos clientes. Para cancelar, basta entrar em contato com nossa equipe. Atenção: Reembolso válido apenas para o serviço de criação de landing pages e taxa de gerenciamento de anúncios (valor gasto com anúncios não é reembolsável).